Cfa Candidate Body Of Knowledge Cbok Pdf

I hit a few trails regularly and really my biggest complaint is clearance. Men's genesis v2100 mountain bike. Model/Year: V2100 2012 Pros: Durable, easily maintainable, cheap Cons: Terrible pedal clearance, seat is hard and handle bars aren't good Recommendation: For what I paid and what it has allowed me to do I have to say money well spent. Don't hesitate to buy the Genesis if you are thinking about getting into biking but be prepared to buy an upgrade bike if you decide that mountain biking is something you like!

Download the EDuke32 engine (click on the Windows icon); Copy the contents of the downloaded zip file to an empty folder of choice; Copy the Duke Nukem 3D game files (DUKE3D.GRP and DUKE.RTS) to that same folderDon't have the game files? Download duke nukem 3d windows 7 free.

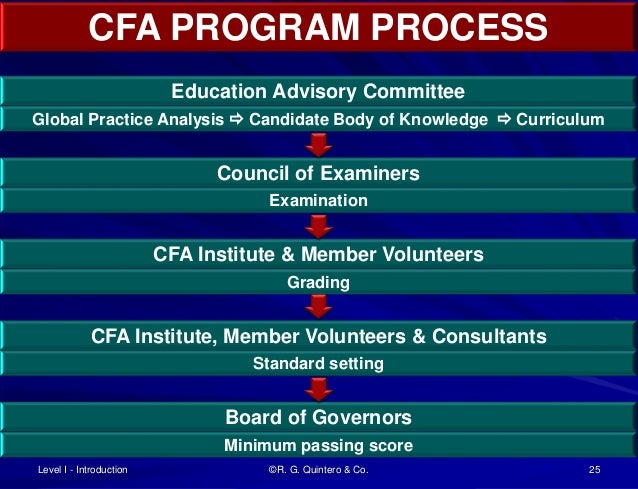

The Candidate Body of Knowledge The CFA Program Candidate Body of Knowledge (CBOK) represents the core knowledge, skills, and abilities (competencies) that are generally accepted and applied by investment professionals throughout the world. In practice, these competencies are used in a generalist context and are expected to be demonstrated by a recently qualified CFA charterholder. The CBOK is depicted graphically in Exhibit 1. The CBOK is determined through a practice analysis process whereby members and employers provide information on current practice as well as anticipated future trends and the competencies that a new CFA charterholder needs in order to practice in the investment profession. This process is described in more detail in The CFA Program: Our Fifth Decade, available here. The current CBOK consists of four components: • • •

•

A broad topic outline that lists the major knowledge areas (see Exhibit 2) 1 ; Topic area weights that indicate the relative exam weightings of the top-level topic areas (see Exhibit 3) 2 ; Learning outcome statements (LOSs) that advise candidates as to what they should be able to do with this knowledge (LOSs are provided in candidate study guides 3 and at the beginning of each reading) ; and The curriculum of material that candidates receive upon exam registration and are expected to master.

Because the CBOK changes over time, the curriculum used in the CFA Program today differs quite a bit from the one used ten years ago. This article describes those changes and provides a resource for charterholders to refresh their knowledge on current topics. A major feature of the current curriculum is that more than half of it was written by prominent practitioners and academics on the basis of CFA Institute’s practice analysis. CFA Institute has repackaged this material into a series of texts that can be used by members, societies, and universities to refresh their own knowledge, provide refresher courses, or educate potential CFA Program candidates. Appendix A contains a list of available texts. Overall Evolution of Topic Areas and Weights

1

Because the CBOK evolves over time, topics and weights may change. This list is current as of the publication of this article. The current version is available here. 2 The current version is available here. 3 The current versions are available here.

The major topics listed in Exhibit 2 (e.g., Ethical and Professional Standards, Quantitative Methods, etc.) have evolved slightly from 2000 to 2010. The relative weighting of these topics in the CFA Program from 2000 to 2010 is provided in Exhibit 3. These ten knowledge domains can be categorized into four broad areas: Ethical and Professional Standards, Investment Tools, Asset Classes, and Portfolio Management and Wealth Planning. Ethical and Professional Standards has been a core of the CBOK and curriculum from the program’s inception in 1962. Although the overall focus in this area has not changed over time, the CFA Institute Code and Standards content has evolved. In Exhibit 3, note that the overall topic weights assigned to ethics (15 percent at Level I, 10 percent at Level II, and 10 percent at Level III) also remained constant over the period. With regard to Investment Tools, the areas of Accounting and Corporate Finance comprised one major topic domain in 2000. Shortly thereafter, the practice analysis process determined that corporate finance was of increasing importance to new charterholders, and accordingly corporate finance was elevated to a top-level topic domain. Similarly, the focus on accounting over the past 10 years gave way to financial statement analysis and then to financial reporting and analysis, reflecting a shift in focus to analysis of all of a company’s financial reports beyond just the financial statements themselves. Further, by 2010 a greater focus was placed on International Financial Reporting Standards (discussed in the next section). With respect to topic weights, by 2010 the Investment Tools topic areas were no longer given specific target weights at Level III; economics, however, was assigned to be tested as part of portfolio management and the remaining tools areas provide the background for evaluation of the asset classes at Level III. The relative weights for financial reporting and corporate finance were increased over the past decade, primarily to reflect the greater importance of corporate finance. With regard to Asset Classes, the focus was shifted from general theory to application to specific asset classes. In 2000, the asset classes listed at the top level of the CBOK topic outline were equity investments, fixed-income investments, and alternative investments. Derivative instruments were listed at a lower level. Early in the decade, investments in derivatives were elevated to one of the top-level topic domains; thus, the current topic outline includes four main asset classes: equity investments, fixed-income investments, derivatives, and alternative investments. Over the decade, the topic weights for the asset classes were increased at all levels, which reflects the increased use of derivatives and alternative investments. Note that individual weights were not provided for each asset class until 2007. During the decade, the domain of Portfolio Management was retitled Portfolio Management and Wealth Planning. This change reflects a continuous evolution toward more private-wealth content in the CBOK and curriculum. Portfolio management for individual investors was included in the CBOK in 2000, however, because of a shift in the marketplace (e.g., from defined-benefit plans to defined-contribution plans); the importance of managing investments for individuals as opposed to institutions has steadily increased.

Evolution of Individual Topic Areas: 2000–2010 This section discusses the major changes in the content of the CBOK and curriculum across all three levels of the curriculum during the past decade. Appendix B shows the major changes by exam level for the period 2000–2010. Ethical and Professional Standards The major changes during the decade were the introduction of a new edition (the ninth) of the Standards of Practice Handbook and the introduction of the Asset Manager Code of Professional Conduct. 4 The ninth edition of the Standards of Practice Handbook contains the code of ethics and related standards. The Asset Manager Code of Professional Conduct (second edition) presents the ethical responsibilities of firms that manage client assets. In addition, the CFA Institute Research Objectivity Standards were added as a required reading. The most significant change was in the area of performance presentation standards. The new Global Investment Performance Standards replaced the AIMR Performance Presentation Standards. The Global Investment Performance Standards (2005) provide standards for the presentation of fair and objective investment results. During the decade, performance standards were moved to the Portfolio Management and Wealth Planning section of the study guides. Quantitative Methods Although the basic topics in this area have not changed over the decade, the readings, which were based on business statistics, were replaced with custom-written material on the investment management industry. This material is found at Levels I and II and has been republished in the second edition of Quantitative Investment Analysis, by DeFusco, McLeavey, Pinto, and Runkle (see Appendix A). Economics Although the readings were updated frequently, the core concepts remained largely unchanged over the decade. Some material on economic fluctuations, unemployment, and inflation, which was listed as preliminary readings (not tested) in 2000, was moved into the main economics study sessions. Information on such financial institutions as central banks was added. At Level III, the focus was shifted from economic forecasting to economic concepts for valuation. Financial Reporting and Analysis This area changed significantly over the decade. The 2000 study guide contained recommended preliminary readings that included information on the accounting cycle (including debits and credits) and other topics. Further, the U.S. Generally Accepted Accounting Principles (GAAP) was a primary focus, with some mentions of the International Financial Reporting Standards (IFRS). The past decade 4

See Appendix A for a list of the publications mentioned in this article and for links to their locations on the CFA Institute website. CFA Centre publications are available for free download. Sample chapters of many of the other publications are available for free download.

saw a continuous trend toward more analysis topics and fewer pure accounting topics, together with a shift to a strong focus on IFRS, consistent with a global trend toward IFRS and harmonization of accounting standards. By 2010, there were no preliminary readings (but some basic optional material was included in the assigned readings), and the readings were based primarily on IFRS. U.S. GAAP is still presented, not as a primary focus, but rather in the context of a candidate’s ability to understand and adjust for differences in global accounting standards. Moreover, new readings about analyzing cash flows and detecting financial reporting irregularities were added. As accounting standards changed, the readings were also changed significantly in content and were moved toward a fair value concept for many assets and liabilities. This new material has been republished in International Financial Statement Analysis, by Robinson, van Greuning, Henry, and Broihahn (see Appendix A). Corporate Finance As previously noted, this area was elevated in importance and weight over the decade. In particular, corporate finance material on capital budgeting, capital structure, and dividend policy was added at Level II. Readings on corporate governance were added at Level I. One currently required reading is The Corporate Governance of Listed Companies: A Manual for Investors, which provides information on how to assess a company’s governance policy. Other readings at Levels I and II of the current curriculum have been republished in Corporate Finance: A Practical Approach, by Clayman, Fridson, and Troughton (see Appendix A). Equity Investments Although the core concepts of analysis and valuation of equity investments did not change, new customwritten readings on valuation were introduced. These readings expand on relative valuation techniques (e.g., price multiples) and present a generic residual income valuation framework (whereas the previous curriculum focused on a single trademark version, EVATM). Additional readings on valuation in emerging markets and valuation of private companies were also introduced. Many of these new readings have been republished in Equity Asset Valuation, by Stowe, Robinson, Pinto, and McLeavey (see Appendix A). Note that a second edition of this book, which will contain a chapter on the new 2010 curriculum, is in process. Fixed-Income Investments At the beginning of the decade, new readings in this area were added to the curriculum to update existing concepts and to introduce new material on yield spreads, yield measures, and measures of interest rate risk. In the second half of the decade, readings about the liquidity conundrum and relative value and hedging methodologies for fixed-income portfolio management were added. Many of these new readings have been republished in the second edition of Fixed Income Analysis, by Fabozzi (see Appendix A).

Derivatives New custom-written readings in this area were added to the curriculum early in the decade. New material introduced during the decade was devoted to forward contracts (rather than being included with futures contracts), risk management applications for derivatives, and credit derivatives. Some of this material (excluding material on risk management and credit derivatives) has been republished in Analysis of Derivatives for the CFA Program, by Chance (see Appendix A). Alternative Investments In 2000, readings in this area were heavily concentrated in real estate and venture capital, with some material on other tangible assets and hedge funds. During the decade, new material on private equity, commodities, and hedge funds was added. New readings that place alternative assets in both valuation and portfolio management contexts were also added. Portfolio Management and Wealth Planning The core concepts of portfolio management remained unchanged throughout the decade, with a focus on both individual and institutional investors. Major changes included an increased focus on behavioral finance (from three readings in 2000 to seven readings in 2010 and a study session dedicated to the topic); a major update to the classic text Managing Investment Portfolios, by Maginn and Tuttle; and enhanced private-wealth perspectives (individual investor content). Although in 2000 some basic tax information was presented in the readings on individual investors, this content was greatly expanded near the end of the decade to include readings on global income tax and estate tax planning for investments, as well as a reading on managing low-basis investments. In addition, concepts concerning human capital and insurance were introduced. On the institutional investor side, new material on liability-driven investing was added. For both individual and institutional investors, readings on measures of risk, value at risk, and global risk management were replaced with a series of new readings that address risk management much more comprehensively, including the use of derivatives in risk management, stress testing, capital allocation, firmwide risk management, and risk budgeting. Finally, new readings on evaluating global portfolio performance were added. Many of these new readings appear in the recently published third edition of Managing Investment Portfolios: A Dynamic Process, edited by Maginn, Tuttle, Pinto, and McLeavey (see Appendix A). Readings on risk management are also found in the areas of Fixed-Income Investments and Derivatives. Summary The CFA Program Candidate Body of Knowledge and curriculum have evolved over the past decade. In some areas, new core concepts have been introduced; in others, concepts have shifted in focus; and in still others, new readings have been introduced to update the presentation of topics. Charterholders can use this article, especially Appendix B, as a guide to develop a plan for refreshing their knowledge by identifying topics that have been added to the program over the past ten years. Societies, universities, and others that would like to offer refresher courses to charterholders can similarly use this article to

guide their efforts. For detailed information on readings and learning outcome statements, the 2010 CFA Program study guides can be used to supplement this article. For those who would like to offer topical courses on the current CFA Program curriculum, a series of texts based on the curriculum is available (see Appendix A).

Exhibit 1

Exhibit 2

CFA Candidate Body of Knowledge (CBOK) Topical Outline I. Ethical and Professional Standards A. Professional Standards of Practice B. Ethical Practices

II. Quantitative Methods A. Time Value of Money B. Probability C. Probability Distributions and Descriptive Statistics D. Sampling and Estimation E. Hypothesis Testing F. Correlation Analysis and Regression G. Time-Series Analysis H. Simulation Analysis I. Technical Analysis

III. Economics A. Market Forces of Supply and Demand B. The Firm and Industry Organization C. Measuring National Income and Growth D. Business Cycles E. The Monetary System F. Inflation G. International Trade and Capital Flows H. Currency Exchange Rates I. Monetary and Fiscal Policy J. Economic Growth and Development K. Effects of Government Regulation

L. Impact of Economic Factors on Investment Markets

IV. Financial Reporting and Analysis A. Financial Reporting System (IFRS and GAAP) B. Principal Financial Statements C. Financial Reporting Quality D. Analysis of Inventories E. Analysis of Long-Lived Assets F. Analysis of Taxes G. Analysis of Debt H. Analysis of Off-Balance-Sheet Assets and Liabilities I. Analysis of Pensions, Stock Compensation, and Other Employee Benefits J. Analysis of Inter-Corporate Investments K. Analysis of Business Combinations L. Analysis of Global Operations M. Ratio and Financial Analysis

V. Corporate Finance A. Corporate Governance B. Dividend Policy C. Capital Investment Decisions D. Business and Financial Risk E. Long-Term Financial Policy F. Short-Term Financial Policy G. Mergers and Acquisitions and Corporate Restructuring

VI. Equity Investments A. Types of Equity Securities and Their Characteristics B. Equity Markets: Characteristics, Institutions, and Benchmarks

C. Fundamental Analysis (Sector, Industry, Company) and the Valuation of Individual Equity Securities D. Equity Market Valuation and Return Analysis E. Special Applications of Fundamental Analysis (Residual Earnings) F. Equity of Hybrid Investment Vehicles

VII. Fixed Income A. Types of Fixed-Income Securities and Their Characteristics B. Fixed-Income Markets: Characteristics, Institutions, and Benchmarks C. Fixed-Income Valuation (Sector, Industry, Company) and Return Analysis D. Term Structure Determination and Yield Spreads E. Analysis of Interest Rate Risk F. Analysis of Credit Risk G. Valuing Bonds with Embedded Options H. Structured Products

VIII. Derivatives A. Types of Derivative Instruments and Their Characteristics B. Forward Markets and Instruments C. Futures Markets and Instruments D. Options Markets and Instruments E. Swaps Markets and Instruments F. Credit Derivatives Markets and Instruments

IX. Alternative Investments A. Types of Alternative Investments and Their Characteristics B. Real Estate C. Private Equity/Venture Capital D. Hedge Funds E. Closely Held Companies and Inactively Traded Securities

F. Distressed Securities/Bankruptcies G. Commodities H. Tangible Assets with Low Liquidity

X. Portfolio Management and Wealth Planning A. Portfolio Concepts B. Management of Individual/Family Investor Portfolios C. Management of Institutional Investor Portfolios D. Pension Plans and Employee Benefit Funds E. Investment Manager Selection F. Other Institutional Investors G. Mutual Funds, Pooled Funds, and ETFs H. Economic Analysis and Setting Capital Market Expectations I. Tax Efficiency J. Asset Allocation (including Currency Overlay) K. Portfolio Construction and Revision L. Equity Portfolio Management Strategies M. Fixed-Income Portfolio Management Strategies N. Alternative Investments Management Strategies O. Risk Management P. Execution of Portfolio Decisions (Trading) Q. Performance Evaluation R. Presentation of Performance Results

Exhibit 3 CFA Program CBOK Topic Weights (in percentages) 2000 Domain

2005

2010

LI

LII

LIII

LI

LII

LIII

LI

LII

LIII

I.

Ethical and Professional Standards

15

10

10

15

10

10

15

10

10

II.

Quantitative Methods

15

0–10

0–10

12

0–10

0–10

12

5–10

0

III.

Economics

12

0–10

0–10

10

0–10

0

10

5–10

0

IV.

Financial Reporting and Analysis

28

25–35

0

20

15–25

0

V.

Corporate Finance

8

5–15

0

VI.

Equity Investments

10

20–30 5–15

12

5–15 10–20

VIII. Derivatives

5

5–15

5–15

IX.

Alternative Investments

3

5–15

5–15

X.

Portfolio Management and Wealth Planning

5

5–15 45–55

25

23

VII. Fixed Income

TOTAL

20–30 0–10

40–50 15–25

10

5–15 40–60

100

100

100

30

5

100

35–45 30–40

5–15 40–60

100

100

100

100

100

Appendix A. Refresher Readings CFA Institute Centre Publications http://www.cfapubs.org/loi/ccb Standards of Practice Handbook, 9th ed. (CFA Institute, 169 pages, June 2005) Asset Manager Code of Professional Conduct, 2nd ed. (CFA Institute, 21 pages, June 2009) Research Objectivity Standards (CFA Institute, 18 pages, October 2004) The Corporate Governance of Listed Companies: A Manual for Investors (CFA Institute, 54 pages, March 2005) CFA Institute Investment Series with Wiley http://www.cfapubs.org/page/books These foundational texts are thoroughly grounded in the highly regarded CFA Program Candidate Body of Knowledge, which serves as the anchor for the three levels of the CFA Program. International Financial Statement Analysis, by Thomas R. Robinson, CFA, Hennie van Greuning, Elaine Henry, and Michael A. Broihahn (Wiley, hardcover, 864 pages, November 2008) Corporate Finance: A Practical Approach, by Michelle R. Clayman, CFA, Martin S. Fridson, CFA, and George H. Troughton, PhD, CFA (Wiley, hardcover, 452 pages, May 2008) Managing Investment Portfolios: A Dynamic Process, 3rd ed., edited by John L. Maginn, CFA, Donald L. Tuttle, CFA, Jerald E. Pinto, CFA, and Dennis W. McLeavey, CFA, with a foreword by Peter L. Bernstein (Wiley, hardcover, 960 pages, March 2007) Fixed Income Analysis, 2nd ed., by Frank J. Fabozzi, CFA, with a foreword by Martin L. Leibowitz (Wiley, hardcover, 768 pages, January 2007) Quantitative Investment Analysis, 2nd ed., by Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA, with a foreword by Mark J. P. Anson, CFA (Wiley, hardcover, 600 pages, January 2007) Equity Asset Valuation, by John D. Stowe, CFA, Thomas R. Robinson, CFA, Jerald E. Pinto, CFA, and Dennis W. McLeavey, CFA, with a foreword by Abby Joseph Cohen, CFA (Wiley, hardcover, 464 pages, January 2007, 2nd ed. forthcoming) Other Books Based on CFA Program Curriculum http://www.cfapubs.org/page/books Analysis of Derivatives for the CFA Program, by Don M. Chance, CFA (AIMR, hardcover, 656 pages, 2003)

CFA Institute Investment Perspectives http://www.cfapubs.org/page/books Addressing the needs of serious investment professionals, these compilations explore less established concepts on the frontiers of investment knowledge and tap into a vast store of knowledge of prominent thought leaders in the financial community. Private Wealth: Wealth Management in Practice, edited by Stephen M. Horan, CFA (CFA Institute Investment Books, January 2009) Investment Performance Measurement: Evaluating and Presenting Results, edited by Philip Lawton, PhD, CFA, CIPM, and Todd Jankowski, CFA (CFA Institute Investment Books, May 2009)

Appendix B. Major Curriculum Changes by Level (2000–2010)

Level I Ethical and Professional Standards • The ninth edition of the Standards of Practice Handbook replaced the eighth edition. • Global Investment Performance Standards and a Level I GIPS workbook replaced the AIMR Performance Presentation Standards Handbook. Quantitative Methods • Readings from Quantitative Methods for Investment Analysis (2nd ed., by DeFusco, McLeavey, et al.) replaced similar content from Statistical Techniques in Business and Economics (10th ed., by Mason, Lind, and Marchal). The new book covers the same content but in a manner that is much more relevant to the investment industry. • Technical analysis, which was previously included with equity valuation readings at Level I, was moved to this area. The 2010 reading for technical analysis is “Technical Analysis,” in Investment Analysis and Portfolio Management (8th ed., by Reilly and Brown, Southwestern, 2005). • The correlation and regression topic was moved to Level II. Economics • In 2000, material on economic fluctuations, unemployment, and inflation was moved from the preliminary readings list to the tested readings list. • Economics (8th ed., by Parkin, Addison-Wesley, 2008) replaced a textbook by Gwartney and Stroup. The basic concepts were unchanged. • A new reading was added: “Overview of Central Banks,” Ch. 1 in International Economic Indicators and Central Banks, by Picker. • Readings on foreign exchange and foreign exchange parity relations were moved to Level II in the latter half of the decade. Investment Tools: Markets and Instruments • This section appeared in 2000 but was consolidated into the asset valuation readings, together with equities, by 2005, and the section name was changed from “Asset Valuation: Equity Securities” to “Asset Valuation: Securities Markets.” A series of new readings covers similar concepts. Financial Reporting and Analysis • Previous texts for both preliminary and main readings were replaced with one new textbook that focuses primarily on IFRS and international accounting standards convergence, with no preliminary readings. Thirteen chapters from International Financial Statement Analysis (by Robinson, van Greuning, Henry, and Broihahn, CFA Institute/Wiley) were added. • During the decade, new readings on detecting financial irregularities and analyzing cash flow were added. In 2010, these readings included “Accounting Shenanigans on the Cash Flow Statement” (by

Siegel, CPA Journal, 2006) and “Financial Reporting Quality: Red Flags and Accounting Warning Signs” (by Robinson and Munter, Commercial Lending Review, 2004). Corporate Finance • Readings by Brigham and Houston were replaced with new material from Corporate Finance: A Practical Approach, by Clayman, Fridson, and Troughton. Although the concepts were largely unchanged, this topic area was elevated in importance. • By 2010, a new reading on corporate governance was added: Corporate Governance of Listed Companies: A Manual for Investors, from the CFA Institute Centre for Financial Market Integrity. Equity Investments • New chapters from Investment Analysis and Portfolio Management (8th ed., by Reilly and Brown) replaced previous readings from the fifth edition. • “Introduction to Price Multiples” (Stowe et al., Wiley, 2007) was added. • “Market Efficiency and Anomalies” (Ch. 1 in Beyond the Random Walk: A Guide to Stock Market Anomalies and Low Risk Investing, by Vijay Singal, CFA, Oxford University Press, 2004) was added to the reading list. The new reading covers similar content with greater depth. • A new edition of Investment Analysis and Portfolio Management provides expanded coverage of efficient capital markets, security market analysis, and industry analysis. Fixed-Income Investments • Fixed Income Analysis for the Chartered Financial Analyst® Program (2nd ed., by Fabozzi) replaced the existing fixed-income readings. The new readings expand coverage of bond sectors and instruments, as well as bond risk. In addition, the new readings introduce material on yield spreads, yield measures, spot and forward rates, and measures of interest rate risk. Derivatives • Analysis of Derivatives for the CFA® Program (by Chance, AIMR) replaced existing readings and added new material on forward markets and risk management applications of option strategies. Alternative Investments • Individual readings on real estate, other tangible assets, investment companies, and venture capital were replaced by a single reading: “Alternative Investments,” in Global Investments (6th ed., by Solnik and McLeavey, Addison-Wesley, 2008). • A new chapter was added: “Investing in Commodities,” in Global Perspectives on Investment Management—Learning from the Leaders (edited by Sullivan, CFA Institute, 2006). Portfolio Management and Wealth Planning • New chapters from Investment Analysis and Portfolio Management (8th ed., by Reilly and Brown) replaced readings from the fifth edition.

Level II Ethical and Professional Standards • The ninth edition of the Standards of Practice Handbook replaced the eighth edition. • A new reading was introduced: Research Objectivity Standards (CFA Institute). Quantitative Methods • Readings from Quantitative Methods for Investment Analysis (2nd ed., by DeFusco, McLeavey, et al.) replaced similar content from Statistical Techniques in Business and Economics (10th ed., by Mason, Lind, and Marchal). In addition to covering much of the existing material in a manner more relevant to the investment industry, the new book introduces material on hypothesis testing. • “An Introduction to Decision Making under Uncertainty,” in Statistical Techniques in Business and Economics (10th ed., by Mason, Lind, and Marchal) was dropped by 2005. • “Fundamental Factor Models,” in Analysis of Financial Statements (by Peterson and Fabozzi, 1999) was dropped by 2005. • Advanced quantitative topics were consolidated at Level II during the decade. The correlation and regression topic was moved here from Level I and time-series analysis was moved here from Level III. Economics • Economics (8th ed., by Parkin, Addison-Wesley, 2008) replaced a textbook by Gwartney and Stroup. Other than a new chapter on economic growth, the basic concepts were unchanged. • Global Investments (6th ed., by Solnik and McLeavey, Prentice Hall, 2008) replaced readings by Shapiro on foreign exchange and foreign exchange parity relations. The new text also offers expanded coverage of international asset pricing. • “The Brave New Business Cycle: No Recession in Sight” (by Dudley and McKelvey, Goldman Sachs, January 1997) was cut. • A new reading was added: “Measuring Economic Activity” (Ch. 3 in Guide to Economic Indicators, Economist, 2007). • “Business Structure, Antitrust, and Regulation,” in Economics: Private and Public Choice (by Gwartney and Stroup, 1997) was replaced by “Regulation and Antitrust Policy in a Global Economy” (Ch. 28 in Economics Today, 14th ed., by Miller). Financial Reporting and Analysis • Previous texts for both preliminary and main readings were replaced with one new textbook that focuses primarily on IFRS. Five chapters from International Financial Statement Analysis (by Robinson, van Greuning, Henry, and Broihahn, CFA Institute/Wiley) were added, including new content on employee compensation plans (share options) and integration of financial statement analysis techniques. • During the decade, new readings on detecting financial irregularities and analyzing cash flow were added. In 2010, these readings included “The Lessons We Learn” (Ch. 10 in Analysis of Financial

Statements, by Peterson and Fabozzi, 2006) and “Evaluating Financial Reporting Quality,” in International Financial Statement Analysis (by Robinson, van Greuning, Henry, and Broihahn, CFA Institute/Wiley). Corporate Finance • In 2000, this topic was covered only in limited ways. By 2010, it had its own section with several new readings from Corporate Finance: A Practical Approach (edited by Clayman, Fridson, and Troughton), including chapters on capital budgeting, capital structure and leverage, dividends and dividend policy, corporate governance, and mergers and acquisitions. Equity Investments • In 2000, a generic asset valuation section preceded the equity readings and contained chapters on valuing assets in general, assessing company performance, financial forecasting, and managing growth. During the decade, this section was combined with the equity valuation section, with custom-written valuation readings from Equity Asset Valuation (by Stowe, Robinson, Pinto, and McLeavey, Wiley, 2nd ed. forthcoming). • The equity valuation readings were greatly expanded with more material on free cash flow valuation, relative valuation, residual income valuation, and private company valuation. Previous readings on residual income valuation had been limited to the trademarked version, EVATM. • “Valuation in Emerging Markets,” in Valuation: Measuring and Managing the Value of Companies (3rd ed., by Copeland, Koller, and Murrin, Wiley, 2000) was added. • “Equity: Market and Instruments” and “Equity: Concepts and Techniques,” in International Investments (5th ed., by Solnik and McLeavey, Addison-Wesley, 2004) were added. • New readings on competitive strategy and industry analysis were added: o “The Five Competitive Forces That Shape Strategy” (by Porter, Harvard Business Review, 2008). o “Industry Analysis” (Ch. 6 in Security Analysis on Wall Street: A Comprehensive Guide to Today’s Valuation Models, by Hook, 1998). Fixed-Income Investments • Fixed Income Analysis for the Chartered Financial Analyst® Program (by Fabozzi, Frank J. Fabozzi Associates, 2000) replaced a variety of readings from several sources. Topical coverage was relatively consistent. • “The Liquidity Conundrum” (by McCulley, Pacific Investment Management Company, 2008) was added late in the decade. Derivatives • Analysis of Derivatives for the CFA® Program (by Chance, AIMR, 2003) replaced Futures, Options & Swaps (by Kolb, 1997) and several short articles. The new readings provide similar topical coverage in a much more compact fashion. In addition, the Chance text expands coverage of forward markets.

•

“Using Credit Derivatives to Enhance Return and Manage Risk” (by Spentzos, CFA Institute Conference Proceedings Quarterly, 2006) was added.

Alternative Investments • Assignments for 2000 included three readings on real estate valuation, alternative assets for institutional investors, and venture capital. By 2010, an entire study session with six readings was devoted to alternative investments, including real estate, private equity, commodities, and hedge funds. Portfolio Management and Wealth Planning • New readings from several sources replaced several readings on asset pricing models, with a focus more on the portfolio management process than on the models. New readings included the following: o “Portfolio Concepts” (Ch. 11 in Quantitative Methods for Investment Analysis, 2nd ed., by DeFusco, McLeavey, Pinto, and Runkle, CFA Institute, 2004). o “A Note on Harry M. Markowitz’s ‘Market Efficiency’: A Theoretical Distinction and So What?” (by Kobor, CFA Institute, 2006). o “International Asset Pricing” (Ch. 4 in Global Investments, 6th ed., by Solnik and McLeavey, Addison-Wesley, 2008). o “The Theory of Active Portfolio Management” (Ch. 27 in Investments, 6th ed., by Bodie, Kane, and Marcus, McGraw-Hill/Irwin, 2005). o “The Portfolio Management Process and the Investment Policy Statement” (in Managing Investment Portfolios: A Dynamic Process, 3rd ed., by Maginn, Tuttle, McLeavey, and Pinto, CFA Institute, 2006).

Level III Ethical and Professional Standards • The ninth edition of the Standards of Practice Handbook replaced the eighth edition. • The Asset Manager Code of Professional Conduct (CFA Institute) was added. • The AIMR Performance Presentation Standards Handbook and related readings were replaced with the GIPS readings from Managing Investment Portfolios: A Dynamic Process. These readings are now located in the Portfolio Management and Wealth Planning study sessions. Quantitative Methods, Economics, Financial Reporting and Analysis, and Corporate Finance were not separately covered at this level in 2000 or 2010. Economics is included in Portfolio Management (below) to the extent that it affects portfolios.

Equity Investments • The 2000 Level III equity curriculum included articles on international equity investing and emerging markets. By 2010, this curriculum was replaced with new readings on general equity portfolio management and corporate governance, as well as readings on international equities and emerging markets, as follows: o “Equity Portfolio Management” (Ch. 7 in Managing Investment Portfolios: A Dynamic Process, 3rd ed., by Gastineau, Olma, and Zielinski, CFA Institute, 2007). o “Corporate Governance” (Ch. 1 [pp. 15–67] in The Theory of Corporate Finance, by Tirole, Princeton University Press, 2006). o “International Equity Benchmarks” (Ch. 10 in Benchmarks and Investment Management, by Siegel, Research Foundation of AIMR, 2003). o “Emerging Markets Finance” (by Bekaert and Harvey, Journal of Empirical Finance, vol. 10, no. 5, Elsevier, December 2003). Fixed-Income Investments • New readings from Managing Investment Portfolios (3rd ed.) and Fixed Income Readings for the Chartered Financial Analyst Program (2nd ed., both edited by Fabozzi, Frank J. Fabozzi Associates, 2004) replaced Bond Markets, Analysis and Strategies (3rd ed., Fabozzi, Prentice-Hall, 1996); the change covered existing content and added material on relative-value methodologies and international bond portfolio management. Derivatives • In 2000, this area was covered in a single study session section, Portfolio Management Applications Using Derivatives. By 2005, Derivatives had been split into two sections, one for forwards and futures and the other for options and swaps. At the end of the decade, they were recombined as Risk Management Applications of Derivatives to complement other risk management readings (listed below under Portfolio Management). • In 2000, derivatives coverage at Level III was primarily offered through Futures, Options & Swaps (2nd ed., by Kolb, Blackwell, 1997). Midway through the decade, the Kolb material covering forwards and futures was replaced with a series of new readings from Analysis of Derivatives for the CFA® Program (by Chance), which covers similar material from a risk management perspective by using forwards, futures, options, and swaps. Alternative Investments • Reading assignments for 2000 included chapters on real estate, risk strategies, market-neutral strategies, and hedge funds. By 2005, these readings were replaced with a comprehensive chapter on using alternative investments in portfolio management and separate material on commodities. o “Alternative Investments Portfolio Management” (Ch. 8 in Managing Investment Portfolios: A Dynamic Process, 3rd ed., by Yau, Schneeweis, Robinson, and Weiss, CFA Institute, 2007). o “Swaps” (Ch. 8 [pp. 247–254, 268–270] in Derivatives Markets, 2nd ed., by McDonald, Addison-Wesley, 2006).

o

“Commodity Forwards and Futures” (Ch. 6 in Derivatives Markets, 2nd ed., by McDonald, Addison-Wesley, 2006).

Portfolio Management and Wealth Planning: Economic Concepts for Asset Valuation in Portfolio Management • Readings from Improving the Investment Decision Process—Better Use of Economic Inputs in Securities Analysis and Portfolio Management (AIMR, 1992) and Economic Analysis for Investment Professionals (AIMR, 1997) were replaced with “Macroanalysis and Microvaluation of the Stock Market” (Ch. 12 in Investment Analysis and Portfolio Management, 8th ed., by Reilly and Brown) and “Dreaming with BRICs: The Path to 2050” (in Global Economics Paper No. 99, by Wilson and Purushothaman, Goldman Sachs, 2003). Portfolio Management and Wealth Planning: Behavioral Finance • Three readings from different sources that covered behavioral finance were replaced with the following seven readings for an entire study session on the subject: o “Heuristic-Driven Bias: The First Theme” (Ch. 2 in Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing, by Shefrin, Oxford University Press, 2002). o “Frame Dependence: The Second Theme” (Ch. 3 in Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing, by Shefrin, Oxford University Press, 2002). o “Inefficient Markets: The Third Theme” (Ch. 4 in Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing, by Shefrin, Oxford University Press, 2002). o “Portfolios, Pyramids, Emotions, and Biases” (Ch.10 in Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing, by Shefrin, Oxford University Press, 2002). o “Investment Decision Making in Defined Contribution Pension Plans” (in Pensions, vol. 10, by Byrne, Henry Stewart Publications, 2004). o “Global Equity Strategy: The Folly of Forecasting: Ignore All Economists, Strategists & Analysts” (in Global Equity Strategy, by Wasserstein, Dresdner Kleinwert, August 2005). o “Alpha Hunters and Beta Grazers” (by Liebowitz, Financial Analysts Journal, CFA Institute, September/October 2005). Portfolio Management and Wealth Planning: Private Wealth Management • In 2000, this study session was titled Individual Investors and is now referred to as Private Wealth Management. The third edition of Managing Investment Portfolios: A Dynamic Process and several new readings provide much more comprehensive information on managing portfolios for individuals, including expanded tax considerations, human capital, and insurance: o “Managing Individual Investor Portfolios” (Ch. 2 in Managing Investment Portfolios: A Dynamic Process, 3rd ed., by Bronson, Scanlan, and Squires, CFA Institute, 2007).

o o o o o

“Taxes and Private Wealth Management in a Global Context” (by Horan and Robinson, CFA Institute, 2008). “Estate Planning in a Global Context” (by Horan and Robinson, CFA Institute, 2009). “Low-Basis Stock” (Ch. 10 in Integrated Wealth Management: The New Direction for Portfolio Managers, by Brunel, Euromoney Institutional Investors, 2002). “Goals-Based Investing: Integrating Traditional and Behavioral Finance” (by Nevins, Journal of Wealth Management, Institutional Investors, 2004). “Lifetime Financial Advice: Human Capital, Asset Allocation, and Insurance” (by Ibbotson, Milevsky, Chen, and Zhu, Research Foundation of CFA Institute, 2007).

Portfolio Management and Wealth Planning: Institutional Investors • Several portfolio management case studies were dropped. • Readings on portfolio policy and pension investing (and corporate risk management) were replaced with three new readings that cover institutional investing, including pensions, more comprehensively: o “Managing Institutional Investor Portfolios” (Ch. 3 in Managing Investment Portfolios: A Dynamic Process, 3rd ed., by Tschampion, Siegel, Takahashi, and Maginn, CFA Institute, 2007). o “Linking Pension Liabilities to Assets” (by Meder and Staub, UBS Global Asset Management, 2006). o “Allocating Shareholder Capital to Pension Plans” (by Merton, Journal of Applied Corporate Finance, vol. 18, Morgan Stanley, Winter 2006). Portfolio Management and Wealth Planning: Capital Market Expectations, Asset Allocation, and Execution of Portfolio Decisions • New readings from Managing Investment Portfolios: A Dynamic Process were introduced. The content was similar to that in the 2000 curriculum, with less of a focus on style investing and more information on international diversification. New readings on executing portfolio decisions, monitoring, and rebalancing replaced similar, older readings that primarily concerned execution and trading. Portfolio Management and Wealth Planning: Risk Measurement and Management • In addition to the previously mentioned readings on derivatives risk management, readings on measures of risk, value at risk, and global risk management were replaced with two new readings that cover risk management much more comprehensively, including currency risk management. Portfolio Management and Wealth Planning: Performance Evaluation and Attribution • A new reading from Managing Investment Portfolios: A Dynamic Process covers substantially the same material, and coverage of global performance evaluation was added from “Global Performance Evaluation” (Ch. 12 [pp. 615–626] in Global Investments, 6th ed., by Solnik and McLeavey, Prentice Hall, 2008).

Cfa Cbok

- CFA Program Curriculum 2017 Level I. The same official curricula that CFA Program candidates receive with. Delivering the Candidate Body of Knowledge (CBOK).

- CFA Program Curriculum 2018 Level II Volumes 1-6 Box Set PDF. That CFA Program candidates receive with. On the Candidate Body of Knowledge (CBOK).

- Guide to the Business Process Management Common Body of Knowledge ABPMP BPM CBOK. The Business Process Management knowledge area. Sony Xperia XZ mineral black.

Cfa Candidate Body Of Knowledge (cbok) Pdf

The Candidate Body Of Knowledge (CBOK) represents the core knowledge, skills, and abilities generally accepted and applied by investment professionals globally. The CBOK is grounded in practice, meaning that panels and surveys of thousands of investment professionals have had input into the curriculum through our practice analysis. PER IMPRESA View PDF CFA Candidate Body of Knowledge (CBOK). View PDF CANDIDATE BODY OF KNOWLEDGE CFA CANDIDATE. Volumes 1-6 (2016) (Pdf). Www.cfainstitute.org The Candidate Body of. And the Candidate Body of Knowledge (CBOK). Programs/cfaprogram/Documents/cfa_program_theory_meets_practi ce.pdf. CFA Program Curriculum 2018 Level I, Volumes 1-6 provides the complete Level I Curriculum for the 2018 exam, delivering the Candidate Body of Knowledge (CBOK) with expert instruction on all 10 topic areas of the CFA Program. Fundamental concepts are explained in-depth with a heavily visual style, while cases and examples.